Non profit

UK: Social enterpise, 3 factors will affect their development

According to David Parker, of Alpha Communication, the factors are: Government support, Legal structure CIC, Social accounting and social audit

Social Enterprise in the UK

What is social enterprise? The UK government currently defines social enterprises as

?businesses with primarily social or environmental objectives whose surpluses are principally reinvested for that purpose in the business or in the community, rather than being driven by the need to maximise profit for shareholders and owners.?

This broad definition includes a wide range of enterprises with many different social and environmental aims.

?Some social enterprises are created by outsourcing public services,

?Some are set up by social entrepreneurs,

?Some emerge from the voluntary sector.

Different types of social enterprise include:

?Public sector externalisations

?Community organisations

?Co-operatives and mutuals

?Social firms

The UK government estimates that

?There are 55,000 social enterprises in the UK

?Social enterprises account for 5% of all businesses with employees

?They have a combined turnover of £27billion (nearly ?40billion) per year.

?They contribute £8.4billion (?12.3billion) per year to the UK economy – almost 1% of annual GDP (gross domestic product).

Three factors affecting the future of social enterprise

Now I want to look at three factors that I believe will shape the development of social enterprise in the UK over the next few years. These are

?Government support

?Legal structure ? CIC

?Social accounting and social audit

Government support

The UK government has published several action plans for social enterprise, two in the last 12 months. These demonstrate the government?s support in principle for social enterprise but so far there has been little practical support. The limited measures announced so far include

?Funding for Regional Development Agencies to improve business support for social enterprises.

?£10million (?14.7million) to promote investment in social enterprises

?A pledge to explore how tax relief could be used to encourage community investment.

?A pledge to tackle the obstacles that make it difficult for social enterprises to win contracts to deliver public services.

It seems likely that the UK government will announce more initiatives to support the development of social enterprises, but I think it is unlikely to allocate significant new funding to this sector.

This new and strict form of company has proved more popular than many people expected. In just 20 months over 900 enterprises have registered as CICs in the UK, operating in a wide variety of sectors including health, leisure, regeneration, education and the arts.

It seems likely the registration of CICs will increase rapidly and that it may well become the legal form of choice for most social enterprises. In fact several existing social enterprises that were registered as ordinary companies have converted to CICs.

Over the last 12 years various individuals and organisations in the UK have been working to develop methods of recording, reporting and independently auditing the social, environmental and economic impact of social enterprises, community and voluntary organisations.

Up to 500 of these organisations in the UK have now produced social accounts. This may not seem very many, but when I consider the big commitment that is involved from people, often volunteers, in small organisations that have few resources and unreliable income streams then I?m surprised that any of them produce social accounts when they don?t have to.

Shortly before coming to Civitas I spoke to the chairman of the UK Social Audit Network, John Pearce, and I asked him if he thought social accounting would ever become compulsory. He said he thought it would for some social enterprises, especially those involved in delivering public services. Furthermore he said that he would welcome an element of compulsion.

He said: ?Most social enterprises think that social accounting is a good idea but because they don?t have to do it they never get around to it, and that?s a shame,?

And he went on: ?Because social reporting gives social enterprises the opportunity to celebrate their core values and to demonstrate their difference.?

I agree with John Pearce, and I would like to finish with this point. It is very important that social enterprises take the lead in social accounting and social audit. If they don?t there is a danger that it will be imposed on them by bureaucrats.

The UK Social Audit Network has links with Germany, Sweden, Finland, Spain and Portugal. This is an area of knowledge and experience where there are huge potential benefits from transnational co-operation. And I with my partners in Vita Europe will try to promote that transnational co-operation by publishing regular examples of innovation, inspiration and integrity.

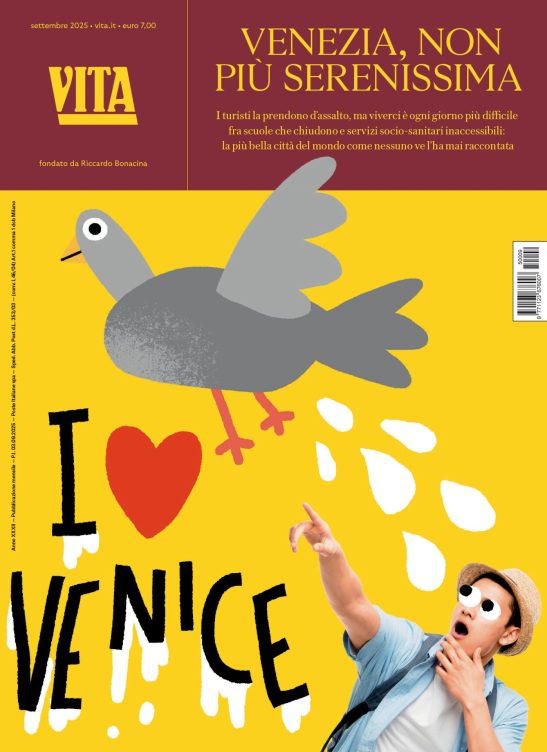

Nessuno ti regala niente, noi sì

Hai letto questo articolo liberamente, senza essere bloccato dopo le prime righe. Ti è piaciuto? L’hai trovato interessante e utile? Gli articoli online di VITA sono in larga parte accessibili gratuitamente. Ci teniamo sia così per sempre, perché l’informazione è un diritto di tutti. E possiamo farlo grazie al supporto di chi si abbona.