Non profit

The third sector

A strong and robust third sector that relies heavily on government funding.

Size and Income

According to an Imagine Canada statistical report on the Canadian third sector (2003), there were approximately 161,000 social organizations operating in Canada. [13]

The distribution of organizations varied across the country. More organizations were located in Quebec (29 percent) and Ontario (28 percent) than in any other province or territory. [13]

Social organizations had combined revenues of $112 billion (CAD) (€86 billion). In Canada Hospital and University organizations are run as non profits. Their combined revenue accounted for one-third of the total revenue figure. Despite their huge economic impact, these organizations only represented one percent of the organizations in this sector. The core non profit sector, which excludes the income of the above- mentioned boasted total revenue of $77.9 billion (CAD)( €59 billion). [13]

Organizations in Ontario accounted for 43 percent of the sectors total income. [13]

Statistics Canada reported that, in 2007, the non profit sector made up seven percent of the Canadian economy (GDP). The core non profit sector was 2.5 percent of GDP. [14]

During this same period the sector grew by seven percent, the core non profit sector grew by 5.8 percent. From 1997 to 2007, the sectors growth in economic activity outpaced that of the overall Canadian economy in six out of the eleven years. [14]

Source of Income

As reported by Image Canada (2003), Canadian non profits received 49 percent of their funds from government sources; 37 percent from earned income sources, including revenue from membership fees and the sale of goods and services; and thirteen percent from individual and corporate donations. [13]

Non profits received funds from all three levels of government – federal, provincial and municipal. The report explains that 40 percent of funds came from the provincial government, seven percent from the federal government and two percent from the municipal government. The fact that the provincial government was the largest source of income to non profits helped explain income and size discrepancies between the different Canadian provinces, within the sector. [13]

The report also found that larger organizations depended more on government support then their smaller counterparts. Government support accounted for 58 percent of total revenue for organizations with annual revenues of $10 million (CAD) (€ 7.6 million) or more. In contrast, smaller organizations relied more on earned income. For organizations with annual revenue less than $30,000 (CAD)( €23,068 million), earned income accounted for 51 percent of their funds. Donations from individual or corporations accounted for eight and three percent respectively of non profits total income. [13]

Main Activities

The Ministry of Industry released a report (2004) stating that the primary areas of activity of Canadian non profits were Sports and recreation (21 percent of all organizations), Religion (19 percent), Social services (12 percent), Grant-making, fundraising, and voluntarism promotion (10 percent), Arts and culture 9 percent) and Development and housing (eight percent). They also included Hospitals, Universities and colleges, Law, advocacy and politics, Environment, Education and research, Health, and International organizations. [15]

Defining the sector: social economy and social innovation

In Canada the term used to define third sector activities has traditionally been the social economy. In recent years actors, outside of the province of Quebec, have started to use of the term social innovation.

The Chantier pour l’economie sociale defined the social economy as an ensemble of activities and organizations, emerging from collective enterprises that pursue common principles and shared structural elements:

· The objective of the social economy enterprise is to serve its members or the community, instead of simply striving for financial profit;

· The social economy enterprise is autonomous of the State;

· In its statute and code of conduct, it establishes a democratic decision-making process that implies the necessary participation of users and workers;

· It prioritizes people and work over capital in the distribution of revenue and surplus;

· Its activities are based on principles of participation, empowerment, and individual and collective responsibility. [3]

Social innovation has a slightly different significance. The employment of this new term is meant to reflect the evolution of the sector in recent years.

According to the organization Social Innovation Generation (SiG), “social innovationis about new ideas that work to address old social problems. Poverty, homelessness, violence are all examples of social problems that still need dedicated solution-seeking space. Social innovation addresses these challenges by applying new learning and strategies to solve these problems.” [5]

Structure:

In 2010 a legal structure for social organizations in Canada was outlined under federal and provincial legislation. At the federal level these organizations were regulated under the Ministry of Industry, a permanent government cabinet. The government institutions that monitor these organizations were Industry Canada and Revenue Canada. Furthermore, the Canada Corporations Act and the Canadian Income Tax Act gave a legal definition for the different entities that make up the third sector in Canada.

Non profit organizations

Non profit organizations were defined by the Canada Corporations Act, Part II, (sections 153 to 157.1(3)). The act “allows the incorporation of non-profit corporations at the federal level. Under the Act, a corporation must not issue shares and its purposes must fit under, or have goals similar to, one of the following categories: national, patriotic, religious, philanthropic, charitable, scientific, artistic, social, professional or sporting.” [6]

Cooperatives

Cooperative corporations were treated as a separate entity, under Canadian law, this was to allow for the fact that they were often set up as profit sharing entities. Under the Canada Cooperative Act, co-operatives were defined as organizations that focus on the needs of their members and development of their community.

Legislation stipulated that there were 6 types of legal co-operatives. The list included financial, consumer, service, producer, worker and multi-stakeholders co-operatives. [7]

Registered Charities

Under Canada’s Income Tax Act a registered charity is defined as “an organization that can issue tax receipts for donations, is generally eligible for government grants, and does not pay income tax on its earnings.” By their definition charities are assigned certain privileges. To obtain the legal status of a registered charity an organization must be reviewed by the Canada Customs and Revenue Agency (CCRA).

According to the CCRA, the term charitable was not defined in the Income Tax Act, so common law (court decisions) is considered when determining what is charitable by law. [8]

Court decisions held that charitable activities include “the relief of poverty, the advancement of education, the advancement of religion and the advancement of certain other purposes that benefit the community” as defined by the courts. [8]

The Canada Revenue Agency reported approximately 80,000 registered charities in Canada(2010). [9]

The September 11, 2001, terrorist attacks led to the enacting of the Charities Registration (Security Information) Act which concerned the status of charitable organizations.

The law enacted by Parliament, in 2001, as Part 6 of the Anti-terrorism Act, provides a mechanism for revoking the registration of any charity or denying registration of an applicant when security information is used to establish that the charity or applicant is involved in supporting terrorism. [10]

In a roundabout way, the Income Tax Act gave a legal definition for social enterprises. The Income Tax Act stated that “charities can lose their registration if they carry on an unrelated business.” Therefore, by implication, the law allowed them to carry on a related business. [11]

The 1980s, and the crisis of the “welfare state” sees profound changes to the Canadian third sector

In the early 1980s Canada, like many other countries, sunk into a deep economic recession. In response to these economic conditions in 1984 Canadians elected Brian Mulroney’s Progressive Conservative party to government. This marked the first time in almost 21 years that Canada’s federal government was in the hands of a conservative party (between 1979 and 1980 a conservative party was in power under Joe Clark).

In an attempt to reduce Canada’s debt, the new government cut spending on social service programs. The government’s cuts to social expenditures coupled with high unemployment rates led to what has been described by researchers as a period of “crisis for socialism and the welfare state” in Canada. [1]

During the crisis, new forms of non profit organizations started to immerge and to take over the provision of welfare programs that the government had eliminated. These community based service organizations were involved in a variety of sectors including employment, daycare, health and social services. [2]

The growth of these social organizations was particularly strong in the Province of Quebec. In 1976 – for the first time – the Quebec nationalist party, le Partie Québecois, was elected as the Provincial government. A Quebecois nationalist and solidarity movement flourished under this new government. The government and civil society refocused their attention on local development. Both factors were key elements in creating the foundations for the Quebec social economy. [1]

Summit on Economy and Employment

In 1996 the Provincial government of Quebec hosted the Quebec Summit on Economy and Employment, a summit that brought together diverse actors from the public, private and civil sector. The purpose of the summit was to discus solutions to high unemployment – 12 percent at the time – and poor economic performance in the region. Nancy Neatman, the Director and President of Chantier de l’économie sociale, who was in attendance at the summit, said that actors from the civil sector “stole the show.” [2] According to her, non profits, associations, cooperatives and mutual’s showed the public and private sector how they could effectively create jobs and contribute to economic development. The summit, therefore, gave the social economy a new sense of legitimacy. [1]

The summit also gave birth to the Chantier pour l’economie sociale one of Quebec’s and Canada’s first social economy networks. Among other contributions, the Chantier has given the social economy an official definition and a common vocabulary. [2]

2000’s and the social innovation movement: the third sector gains popularity and political support

On March 23, 2004, the Canadian Federal government, under the then Prime Minister Paul Martin, created the Secretariat for the Social Economy and introduced a new social economy development policy. This policy earmarked $100 million (CAD)( € 76.6 million) in funding for capital investments in social economy enterprises. [4] Interesting to note that Paul Martin was the regional development minister for Quebec in the early 1990s, and is, therefore, a direct product of the Quebec social economy movement.

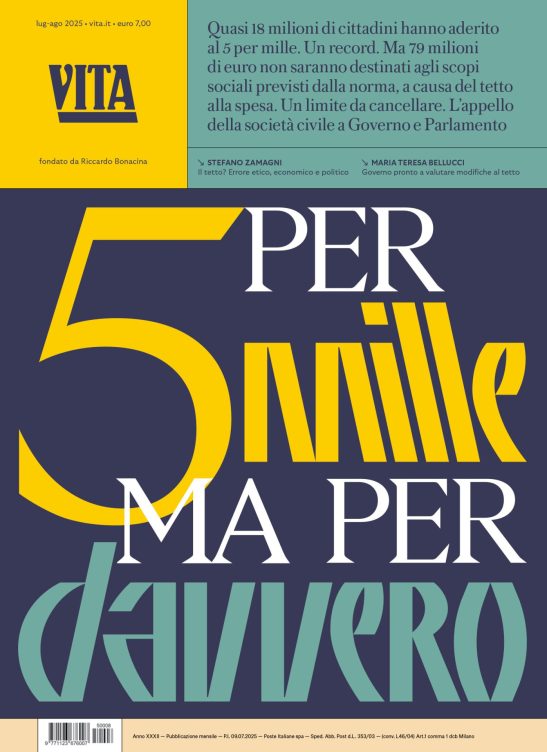

Cosa fa VITA?

Da 30 anni VITA è la testata di riferimento dell’innovazione sociale, dell’attivismo civico e del Terzo settore. Siamo un’impresa sociale senza scopo di lucro: raccontiamo storie, promuoviamo campagne, interpelliamo le imprese, la politica e le istituzioni per promuovere i valori dell’interesse generale e del bene comune. Se riusciamo a farlo è grazie a chi decide di sostenerci.