Non profit

Spain: Microloan success a mixed blessing

Microloans have taken off in a big way in Spain in the past two years, but experts warn that they risk becoming standard financial products and not tools for social inclusion

di Ges

Social microloans are the increase. According to the 2006 report of activities of CECA (Spanish Confederation of Saving Banks), 4,927 microloans were awarded in Spain in 2006, amounting to 51,2 million euros. This figure is higher than the amount that microloans had accumulated until 2005 and since 2001, when this financial product addressed to people in risk of labour, social and economic exclusion was launched. But this increase has its negative side: a number of financial organisations have warned that microloans risk becoming a standard financial product that could be losing its initial focus of contributing to social inclusion.

In the last six years Spanish saving banks have awarded a total figure of 9,033 microloans that had amounted to more than 97,2 million euros. To this amount the loans awarded by saving banks in co-operation with the Institute for Official Credit (ICO), by the Spanish Women?s Institute in co-operation with ?La Caixa? and the Department of Small and Medium Enterprises of the Spanish Government must be added.

The average amount of these microloans is 10,000 euros, which help to launch new businesses ? of these 90 per cent are still in operation two years later. The standard profile beneficiaries? Middle-aged migrant women who wish to start a new business in the service sector. Migrants amount to 74.5% of the individuals applying for a microloan, Latin Americans taking first place. Other beneficiaries are Spanish women (13.4% of all beneficiaries), long-term unemployed individuals, single parent families and unemployed youngsters.

More info:

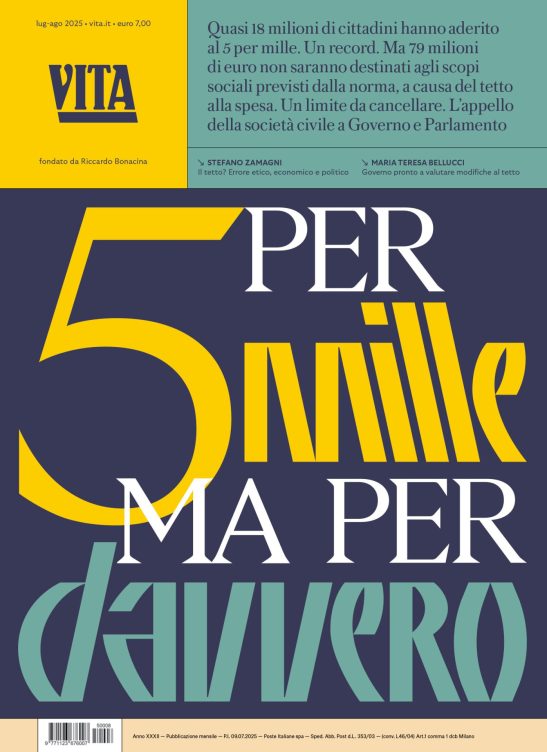

17 centesimi al giorno sono troppi?

Poco più di un euro a settimana, un caffè al bar o forse meno. 60 euro l’anno per tutti i contenuti di VITA, gli articoli online senza pubblicità, i magazine, le newsletter, i podcast, le infografiche e i libri digitali. Ma soprattutto per aiutarci a raccontare il sociale con sempre maggiore forza e incisività.