Non profit

Philanthropy

A strong and robust third sector that relies heavily on government funding.

Individual giving

Between 2003 -2004, over 22 million Canadians made a financial donation to a charitable or other non profit organization. The amount donated totaled $8.9 billion (CAD) (€6.8 billion). [15]

Nationally, the average donor gave $400 (CAD) (€307). Provincially, the average annual donation varied from a high of $500 (CAD) (€385) in Ontario, to a low of $176 (CAD) (€ 135) in Quebec. [15]

Charities relied on a relatively small group of donors for the bulk of their support, the top ten percent who gave $850 (€655) or more accounted for 62 percent of the total value of all donations. [15]

Corporate giving

Corporate philanthropy is not well developed in Canada. In 2003, According to Macleans, a Canadian news magazine, and an Imagine Canada report, “only three per cent of Canadian businesses claimed charitable donations on their tax returns.” That year corporate donations totaled $1 billion (CAD)( €770 million). [16]

John Peloza, researcher and professor at the University of Simon Fraser, explains that there are two reasons for this:

“First, Canada has relatively strong government funding for the non profit sector. As a society Canada tends to value the role of the social safety net. Although the need is certainly there, and rates tend to be lower, the end level of public service is fairly consistent and I think this might keep some firms on the sidelines.

Furthermore, in some respects, Canada has a corporate presence that is very influenced by the United States. Many of its firms are Canadian operations of American firms. Part of the reality in corporate philanthropy is that the dollars tend to go where the senior management resides, both on a national and even a local level.” [17]

Role of Tax Credit

Under Canada’s Income Tax Act (April, 2010),Canadians can reclaim part of their taxed income in the form of a tax credit when they make charitable donations of more than $200 (CAD) (€153).The first $200 (CAD) donated to a charity is eligible for a federal tax credit of 15 percent of the donation amount. After the first $200 (CAD), the federal tax credit increases to 29 percent of the amount over $200 (CAD). Generally, Canadians can claim all or part of this amount up to a limit of 75 percent of their net income. [18]

In 2010 non profit organizations like Imagine Canada were lobbying that the government increase this tax credit to provide a further incentive for Canadians to donate. The initiative, The Stretch Tax Credit for Charitable Giving, would increase the federal charitable tax credit from 29% to 39% on all new giving that was over $200. The House of Commons was considering this proposal in 2010. [19]

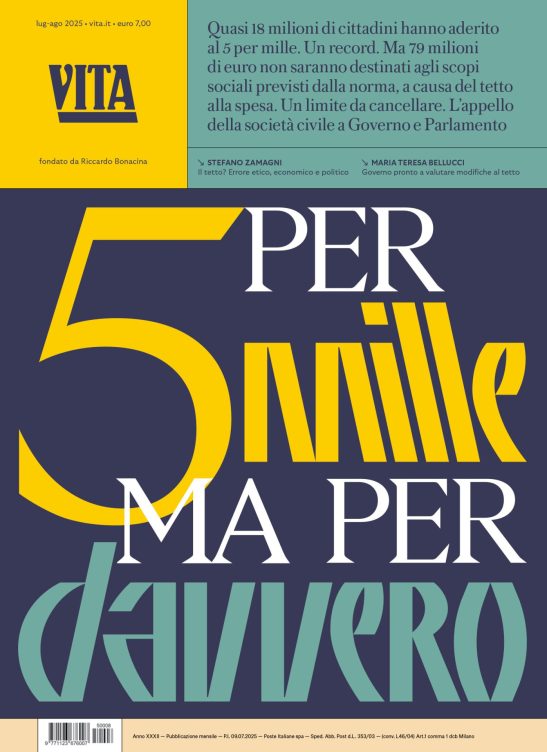

Nessuno ti regala niente, noi sì

Hai letto questo articolo liberamente, senza essere bloccato dopo le prime righe. Ti è piaciuto? L’hai trovato interessante e utile? Gli articoli online di VITA sono in larga parte accessibili gratuitamente. Ci teniamo sia così per sempre, perché l’informazione è un diritto di tutti. E possiamo farlo grazie al supporto di chi si abbona.