The news that the Norway’s SWF decided to exclude from the investment universe a couple of Israeli companies, involved in building settlements in East Jerusalem, attracted a lot of interest from the public opinion around the World. The attention was compounded by another episode: the decision of Scarlett Johansson to sever her relationship with Oxfam because of the (now viral) Sodastream spot. Sodastream has a factory in an “occupied territory” and Oxfam is promoting a boycott of all the Israeli companies “exploiting” Palestinians in occupied territories.

The Norway’s SWF is a Government Pension Fund into which the surplus wealth produced by Norwegian petroleum income is deposited. It manages 800 bln euros, holding 1% of global equity markets, and it is one of the biggest fund in the Word. The investment policy of the SWF has to respect the ethical guidelines set forth by a Council of Ethics, established by royal decree in 2004. According to its ethical guidelines, the SWF ”considers sound financial return over time to be conditional upon sustainable economic, environmental and social development, as well as well-functioning, legitimate and efficient markets.”

If they were so meticulous in analyzing and excluding from their portfolio a company like the Africa Israel Investments, Ltd whose market cap is 275mln euro, you would expect a special attention to the big western companies operating in dubious industries. After all, according to the Guidelines, they may “on the advice of the Council of Ethics, exclude companies from the investment universe of the Fund if there is an unacceptable risk that the company contributes to or is responsible for: a) serious or systematic human rights violations ….; b) serious violations of the rights of individuals in situations of war or conflict; c) severe environmental damage; d) gross corruption; e) other particularly serious violations of fundamental ethical norms.”

It is clear that the definition of “fundamental ethical norms” is arbitrary, varying according to cultural and religious beliefs. Obviously, as a member of the Italian’s NoSlot Movement, I am biased in considering not “ethical” the machine gambling business. Therefore, we need to see what Norway’s government is considering “ethical” and “socially sustainable” for his citizen. This is necessary because if Norway’s government is not tolerating some practices for his citizen, then it should apply the same “ethical” metrics for the other human beings residing in different spots of our World.

Norway banned slot machines in 2003 and the gambling industry sued. In the “STATEMENT OF DEFENCE BY THE GOVERNMENT OF THE KINGDOM OF NORWAY”, 18th of May 2006, the Norwegian government defended vigorously the decision. “The main legislative aim of the reform is to fight problem gambling, which in recent years for the first time in history has become a huge problem in Norway, for a large number of individuals as well as to society as such. This problem is almost entirely caused by an exponential increase in the gambling on slot machines, which is the most addictive form of gambling legally operated in Norway today …. Slot machines were until the mid-1990s a small and harmless sector, but have since developed into by far the largest and most problematic form of gambling in Norway – creating deep misery and huge private profits.”

But the best words that underline the problem with the gambling industry as a whole are: “the main argument for restricting games of chance (lotteries and gaming) under Norwegian law has always been, and still is, social policy considerations – to prevent, minimize and contain problem gambling (compulsive, habitual, pathological), and other gambling problems for society. The moral and cultural policy aspects have also historically been strong, and to some extent still are.”

You would then expect the Norway’s SWF not investing into companies involved in gambling, not to say machine gambling. Well, not quite so.

On the website of the Norges Bank, the investment manager of the fund, you can find the equity holdings (here). As far as gambling companies are concerned, you find that the fund invests in Lottomatica (0.74% of the capital), SNAI (0.01%), OPAP (1.84%), Ladbrokes (2.31%), William Hill (3.06%), Las Vegas Sands (0.37%)….

It would be interesting to hear from the Council of Ethics the reason why an activity, deemed to create “deep misery and huge profits” at home, be tolerated abroad.

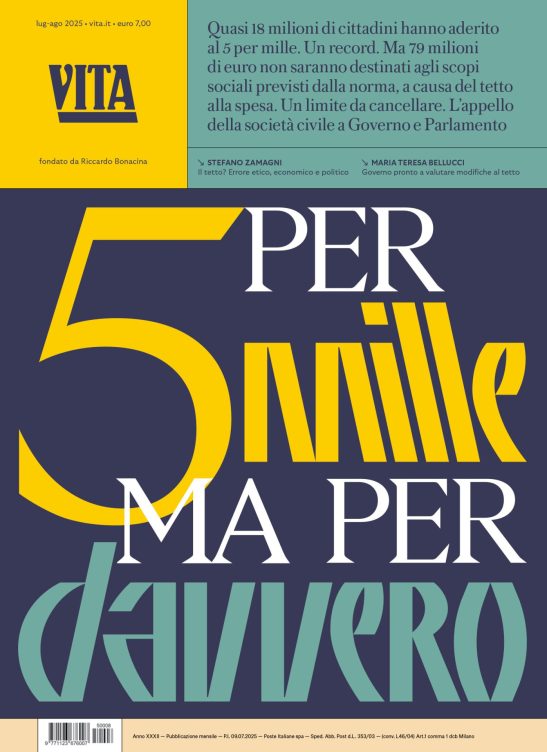

Cosa fa VITA?

Da 30 anni VITA è la testata di riferimento dell’innovazione sociale, dell’attivismo civico e del Terzo settore. Siamo un’impresa sociale senza scopo di lucro: raccontiamo storie, promuoviamo campagne, interpelliamo le imprese, la politica e le istituzioni per promuovere i valori dell’interesse generale e del bene comune. Se riusciamo a farlo è grazie a chi decide di sostenerci.