Volontariato

France: offering social microcredit everywhere

La Poste group has just be authorized to deliver small loans to not bankable people in all its Banque postale offices

di Zesst

Some 10 000 social microcredits are expected to be attributed in 2007 by the French Postal Bank. This quiet revolution will allow the delivering of small loans (less than 3 000 euros) to any people facing temporary difficulties to survive or to access training or job opportunities.

Since postal offices are well distributed all over the national territory, the objective of filling a serious gap, especially in rural and suburban areas, sounds as an easy target. Social microcredit schemes are handled by the Caisse des dépôts under the Social Cohesion plan, adopted in january 2005.

This new spread is emblematic of a new culture embracing part of the credit system. The Yunus stake ” making money with the poors ” for revitalizing the economy and fostering hope is opening new horizons to some old institutions like the Post office or municipal credit bodies.

The revamp of their services tends to assert the increasing economic difficulties hurting particularly the the low middle class. In the meantime, the french postal bank updates its public profile in order to preserve its customers along the lines of general social services and the EU social economy market.

More info:

www.laposte.fr

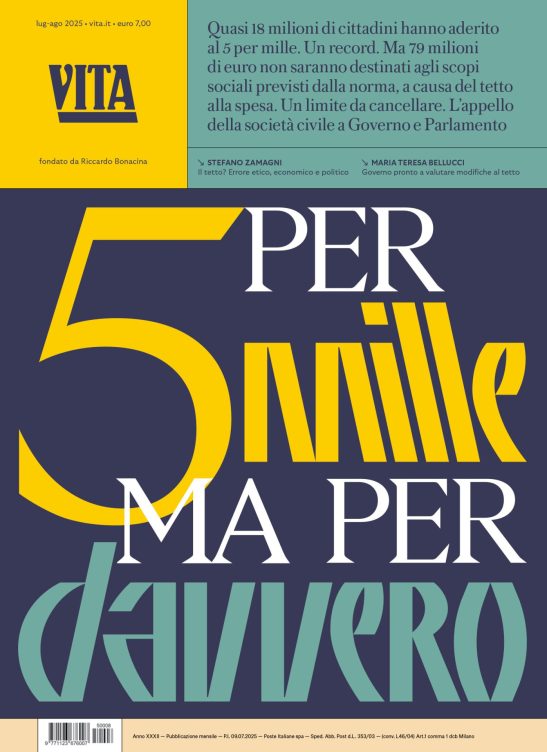

Si può usare la Carta docente per abbonarsi a VITA?

Certo che sì! Basta emettere un buono sulla piattaforma del ministero del valore dell’abbonamento che si intende acquistare (1 anno carta + digital a 80€ o 1 anno digital a 60€) e inviarci il codice del buono a abbonamenti@vita.it