Non profit

Ethical finance

A strong and robust third sector that relies heavily on government funding.

Credit Unions

The oldest and strongest forms of ethical finance in Canada are financial cooperative organizations, better known as credit unions.

Dr. Mcpherson, professor and researcher at the University of Victoria, explained in an interview that credit unions, like other forms of cooperative organizations, are owned by their members. In the case of credit unions, members are also those who would deposit or borrow from these institutions. [25]

These institutions are seen as a form of ethical finance, because they are characterized as being locally based, profit sharing and active in local community support projects. Credit unions are strongest in rural Canada and they are often the only financial institution in smaller communities. [25]

Brief history

The first credit union, La caisse populaire Desjardins, was established in Levis, Quebec, in 1900, by Alphonse Desjardins. Throughout its history Desjardins had strong links with the social economy movement in Quebec and with the Quebec nationalist movement. Subsequently, not only is it one of the main actors in Quebec’s social economy, but it is also the most important financial institution in the province. According to a 2003 OECD report on the non profit sector, over 65 percent of Quebecois were members of this credit union. The report added that the major accounts for the top Quebecois non profit organizations were held by Desjardins. [26]

Statistics

There are 3,500 credit union branches in Canada which collectively hold $ 180 billion (CAD) (€138 billion) in assets, or 10 percent of total assets for deposit making financial institutions in Canada. [25] The Credit Union Central of Canada, the largest credit union association in Canada, said that the 100 largest credit unions in Canada reported combined assets of close to $133 billion (CAD) (€102 billion), a six-month increase of 3.8 per cent over the second quarter of 2009. [27] Approximately 10.6 million Canadians are members of a credit union, or one-third of the population. [25]

Socially Responsible Investing

Socially responsible investing (SRI) integrates environmental, social and governance (ESG) performance research into decision making. [28]

In Canada, SRI first gathered momentum in the late 1980s. In 1989, the Social Investment Organization’s (SIO) Association was established, a national non profit association for the socially responsible investment industry in Canada. [29]

The Jantzi Social Index (JSI) was established in 2000. The JSI is a socially screened, market capitalization-weighted common stock index benchmarked against the S&P/TSX 60. In 2010 it consisted of 60 Canadian companies that passed a set of broadly based environmental, social and governance rating criteria. According to a report published by the SIO, in 2008, Canadian socially responsible investment assets amounted to $54 billion (CAD) (€41 billion). [29]

There are three forms of value-based investing in Canada: screening based on exclusionary or inclusionary criteria; community investment; and socially responsible lending. The most important form, in terms of cumulative assets, is social investing based on social and environmental exclusionary or inclusionary screening. In 2008, screened assets totaled $27.56 billion (CAD) (€21 billion), this is a drop from 2006 when assets from this industry totaled 36.49 billion (CAD) (€28 billion). Industry analysts suggest the drop is due to overall decline in market conditions. [30]

Stephanie LeNguyen, Sustainability Analyst, Jantzi-Sustainalytics (a Canadian-Dutch company), added that SRI has evolved away from just negative screens to analysis that better informs investment strategies. Best of sector rankings is an example of a new form SRI that is gaining popularity in Canada. “Best of sector is exactly how it sounds,” said LeNguyen, “it looks at the most socially responsible companies in each sector. This method takes into account that a mining company will of course have a larger environmental and social impact than say a bank but we want to see which mining companies are doing the most to lessen their impacts.” [28]

The top two client groups for these types of funds are insurance companies and religious institutions, who own $5.6509 million (CAD) (€4.3 million) in assets and $2.978 million (CAD) (€2.2 million) in assets respectively. Individual investors only make up two percent of SIR clients. [30]

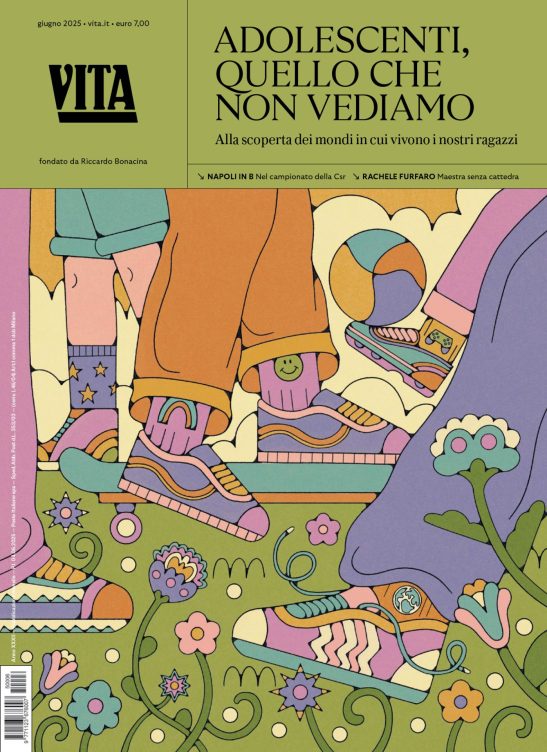

17 centesimi al giorno sono troppi?

Poco più di un euro a settimana, un caffè al bar o forse meno. 60 euro l’anno per tutti i contenuti di VITA, gli articoli online senza pubblicità, i magazine, le newsletter, i podcast, le infografiche e i libri digitali. Ma soprattutto per aiutarci a raccontare il sociale con sempre maggiore forza e incisività.