The Danish Government said European Union rules prevented it from freeing charities from the burden of irrecoverable VAT. But a solution has been found. David Ainsworth of Third Sector reported (27 May 2009).

Charities in the UK remain locked in a struggle over categories of VAT that they – unlike businesses – cannot reclaim. But elsewhere in Europe, the search for a solution to a similar problem is well under way.

In 2007, the Danish government became the first in the European Union to offer charities rebates on irrecoverable VAT. Danish charities are now able to submit claims to their government and receive grants equal to the amounts of VAT they have paid and cannot recover.

This ground-breaking decision came after a five-year campaign by Isobro, the Danish umbrella organisation for charities. Isobro’s victory has effectively demolished an argument consistently employed by the Government here – that the refunding of VAT paid by charities is prohibited by EU law – specifically, the sixth VAT directive, which harmonises VAT collection throughout EU member states.

The Danish scheme is now in its third year, and has so far led to rebates worth about £18m – a quarter of the Danish charity sector’s estimated £75m VAT bill for that period.

The campaign to win this relief took more than five years, according to Mette Holm, head of secretariat at Isobro. It started in December 2001 with a meeting between Isobro and the then minister for taxation, Sven Erik Hovmand.

Hovmand told charities he was not opposed to the idea, thus motivating to them to collect more information.

But officials dragged their feet, and it was late in 2002 before an opposition party in the Danish parliament proposed the idea in a bill. The bill met strong opposition and was withdrawn.

“The fundraising sector in Denmark was facing into a strong headwind at this point,” says Holm. “To make matters worse, an article in the Danish national newspaper Berlingske Tidende claimed the entire sector was inefficient, spending too much money on administration and fundraising. Before we could go on, we had to produce detailed figures for the government rejecting this.”

It was not until the summer of 2004, Holm says, that the government finally agreed to look at the problem, promising that it would examine it in the 2005 state budget.

But the issue was sidelined in the budget and did not come to the fore again until January 2006, when the government said it could not provide a rebate without falling foul of EU regulations, including the sixth VAT directive.

This time, however, Isobro was able to produce a statement from Laszlo Kovacs, the EU commissioner for taxation and customs. It said: “The European Commission has always considered that any scheme designed to relieve the VAT burden for charitable activities can be regarded as compatible with EU legislation if it is clearly separated from the VAT system itself.”

Kovacs’ statement proved to be the breakthrough. With his support for the scheme, the main pillar of the Danish government’s argument collapsed.

“The government had assumed it was forbidden under EU regulations,” says Poul Moller, head of fundraising at the Danish Cancer Society, which campaigned for the VAT refund to be introduced. “They told us they would love to help, were very sympathetic and the only thing preventing them were the EU rules that made it impossible. They had used that line when they were speaking to the press and public support was behind us. When they found out it was possible, they had already backed themselves into a corner. They had to agree.”

Moller says the same principle could be used elsewhere. “Many governments still genuinely believe they are not allowed to do it, despite the model here in Denmark,” he says. “Whether other governments could be persuaded in the same way, I don’t know.”

It has not been plain sailing, he says. The solution proposed by the Danish government has been complicated and difficult to use, with charities able to claim rebates only on increases from their VAT level in 2004, when a model for the scheme was first drawn up.

“But there is an advantage to this,” Moller says. “Charities could claim a very small amount in the first year, so it was not a big shock to the government. It increases gradually each year, so each year it is not a big shock and the government does not notice the increase.

“Soon it will be part of the system. I do not think it will ever be repealed.”

Source: www.thirdsector.co.uk

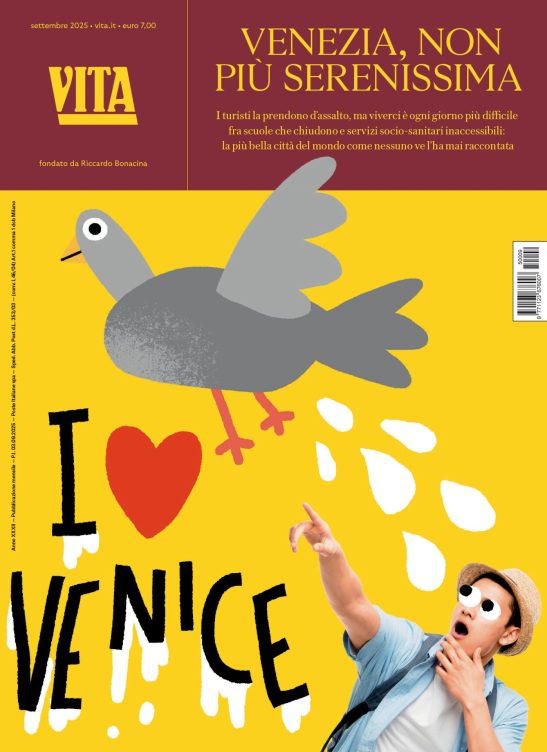

17 centesimi al giorno sono troppi?

Poco più di un euro a settimana, un caffè al bar o forse meno. 60 euro l’anno per tutti i contenuti di VITA, gli articoli online senza pubblicità, i magazine, le newsletter, i podcast, le infografiche e i libri digitali. Ma soprattutto per aiutarci a raccontare il sociale con sempre maggiore forza e incisività.