Economia

Corporate investors not meeting responsible targets

Corporate failings on key environmental and social issues pose big risks for investors

di Staff

80% of the world’s largest companies listed on the FTSE All World Developed Index face huge environmental, social and governance risks, reveals a report on responsible investment by EIRIS.

The global financial crisis underlines the need for more sophisticated risk management, greater transparency and more active engagement with companies, say responsible investment specialists EIRIS. The organisation’s latest report, The State of Responsible Business in 2008: Implications for PRI signatories, focuses on approximately 2,300 global companies and highlights the areas in which there are significant, unmanaged risks. These include in particular: climate change, human rights, bribery and labour standards in the supply chain and are the key areas covered by the United Nations Global Compact (UNGC). The report highlights the challenges these risks present to UN PRI (Principles of Responsabile Investment) signatories and other investors:

Climate change – very high impact sectors such as oil & gas account for over half of total global greenhouse gas emissions. But globally only 10% of companies in very high impact sectors have adopted a good or advanced response to climate change risk. If companies are to meaningfully address climate change they need to significantly reduce their carbon emissions

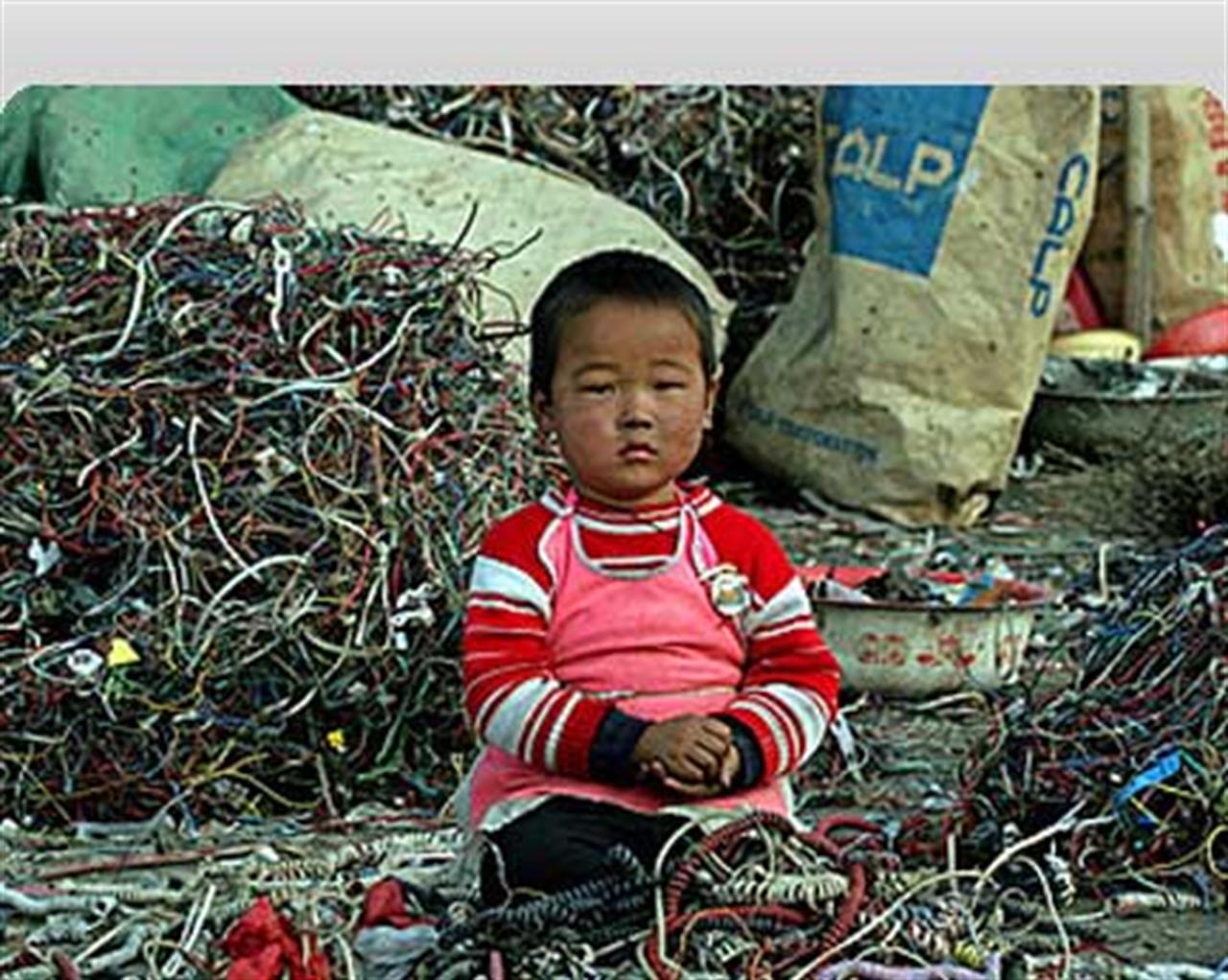

Human rights – around a quarter of companies face high exposure to risk in this area, but only 10% of these companies have adopted good practices to manage human rights and labour standards in their supply chains

Environment – Over 50% of high impact companies demonstrated a good management response. However, numerous companies face unmitigated environmental risks particularly in North America and Asia ex-Japan

Bribery and corruption – only 10% of high risk companies manage their bribery risks to a good standard

Reporting not up to scratch

EIRIS’ research also reveals very poor corporate disclosure on environment, social and governance (ESG) issues. It shows that ESG reporting lags behind performance on all UN Global Compact issues except climate change. Globally, ESG reporting is not good enough for investors to be clear about the risks they face, or what companies are doing to manage those risks.

There is a growing view among investment professionals that environmental, social and corporate governance (ESG) issues can affect the performance of investment portfolios. The United Nations Principles for Responsible Investment (PRI) exist to promote the incorporation of ESG factors into investment risk analysis.

The solution: understanding risk managment

The State of Responsible Business in 2008: Implications for PRI signatories highlights the opportunities which exist for PRI signatories and other investors for greater collaboration on ESG issues; opportunities for integration particularly on environment; engagement priorities and best practice examples on all issues and opportunities to improve disclosure, in particular via reporting initiatives such as the Carbon Disclosure Project and Global Reporting Initiative.

“The global financial crisis underlines the crucial need for a more sophisticated understanding of risk management. A growing number of investors are recognising that ESG factors are key to protecting shareholder value and mitigating risks” said Peter Webster, EIRIS Executive Director. “Our report identifies opportunities for PRI signatories and other investors looking to fully integrate ESG issues into their investment strategies and valuation models”.

Find out more: www.eiris.org

Nessuno ti regala niente, noi sì

Hai letto questo articolo liberamente, senza essere bloccato dopo le prime righe. Ti è piaciuto? L’hai trovato interessante e utile? Gli articoli online di VITA sono in larga parte accessibili gratuitamente. Ci teniamo sia così per sempre, perché l’informazione è un diritto di tutti. E possiamo farlo grazie al supporto di chi si abbona.