Mondo

Brazil: A fresh look at the non profit sector

More than 1.5 million people employed and 10 million volunteers. These are the figures of the Brazilian third sector today. A look at how and why, by Juliana Toledo and Michael Ambjorn

di Staff

In this article we take a closer look at the third sector in Brazil – specifically we will give a historical context, talk a bit about the number and structure of non-profit organizations, their sources of funds, their relationship with the government, laws that promote development of the third sector and philanthropy and we will also set out some recommendations for the future.

Sector Background

Even though the first "non-profit" organization, a hospital, was registered in Brazil in 1543 (predating the term by several hundred years, hence the inverted commas) it took a fair while for the landscape to develop into what it is today. In fact, strong sustainable social movements as seen in the Brazil we know now, were not feasible during the military dictatorship that was in place from the late 1960s through to the 1980s. Partly because the mechanisms for vertical integration, such as political parties and unions, were weakened by the prevailing public policies at the time. Thus the evolution of the sector as we know it today was quite different from how it developed in, for comparison, most European countries.

Social, civic and voluntary movements were however born nevertheless by emphasizing action at a local level, but it happened without integration with public policies and this gave them an unstable nature (and made them understandably difficult to count). They lacked formal structure for governance but with the support of community/neighbourhood groups and the ecclesiastic community, such social movements were the basis for the creation of what we believe is a unique Brazilian culture of non-governmental action. Elements of which are still strong today.

To give an idea of the growth, in 1985 there were some 400-odd NGOs, and just six years later in 1991, there were in excess of 1300 according to a World Resources Institute survey done in the early 1990s. The latest numbers available from the Brazilian Institute of Statistics and Geography (IBGE 2004) show an amazing growth in the intervening thirteen years: from 1300 to 276.000 organizations employing more than a million and a half people and drawing in an estimated volunteer force of tens of millions, making Brazil one of the most socially active countries in the world. There is a reason why the World Social Forum started in Brazil. There is plenty to get on with in other words.

The first non-profit entities in the modern sense, created at the end of the 70s, were conceived as a possibility of parallel organizations to the authoritarian regime. They formed research centers, groups for popular education and support groups to the social movements, outside universities and schools and disconnected from local and national political organizations. These organizations were not created with a long-range view but rather to deal with the issues at hand at the time.

During the 80s, with the end of military dictatorship and the calling of the general assembly for creation of a new Constitution, the social movements started to form organized groups for pressure in the legislative process.

From that period on, the participation of the private sector in the discussions and activities related to the public sector evolved fast and formal structure was imposed. Many advocacy groups were also born alongside the creation of non-governmental organizations of a private nature, but with a public role, dedicated to the socio-cultural needs not satisfied by the market or by public programmes. These were the first and main step for the formation of the Third Sector in Brazil as we know it today.

As the barriers set by the military regime were being removed, the non-profit organizations gained more consistency and strength. As the leaders of the non-profit organizations started to work closely with representative institutions such as unions, social movements and non-government bodies, they were convinced that the activities of public interest could indeed be carried out apart from the Government and the concept of private initiative had been incorporated into some aspects of social work.

After three decades of action and improvements, the Third Sector in Brazil is consolidated as a third path, between the private and public sectors, generating income, jobs and services. It also has a growing influence in the changes and creation of public policies and in the strategic planning of corporations such as the industrial conglomerates, oil companies and the big banks.

Legal framework

Brazil is a civil law country and there is a provision for two forms of not-for-profit private legal entities: Associations and Foundations (Law 10.406 of January 10, 2002).

The legislative process concerning the governance of activities in the public realm specifically govern the interests and influence that make up the relationship of non-profit organizations in relation to the government. Although development of projects and activities of public interest has significantly increased since 1990, many laws regarding social assistance, philanthropy and public utility services were enacted before this growth and many are still in force.

The Constitution of Brazil was revised in 1998 to guarantee freedom of association (with the one exception being the general rule that people may not form groups of a military nature or associate for unlawful purposes).

Currently, Foundations are limited to religious, moral, cultural, or assistance purposes. There is a debate over the exclusion of other public interest purposes, such as education, environmental conservation not to mention research and development.

With regard to tax for Brazilian non-profit entities, the Federal Constitution exempts educational and social assistance organizations from taxes at all levels. To be eligible, an educational or social assistance organization must observe requirements set forth in a number of federal laws. Organizations that do not qualify for constitutional tax exemptions may be eligible to receive some tax benefits at the federal, state, and municipal level.

The income and the corporate tax laws provide donors with some tax benefits, which may be relevant to corporations considering whether or not to make a direct grant to an organization in Brazil.

According to the nature of their purposes and activities, corporate structure and composition of administrative bodies, not-for-profit organizations in Brazil, whether an association or foundation, may qualify for one of five special designations:

1. Civil Society Organizations for the Public Interest (known as OSCIPs);

2. Social Organizations (known as OSs);

3. Public Utility Status;

4. Social Assistance Registry; and

5. Social Assistance Beneficent Entity Certification.

Special designations are not mandatory for private entities to qualify as not-for-profit. But in light of practical administrative issues, and the legal benefits they confer, these designations are useful to both grant makers and organizations. Because the designations may lead to a specific tax treatment, comprising exemptions and possibility of tax deduction by donors and sponsors, a grant maker should inquire whether a not-for-profit entity has one of the designations.

According to the legal status derived from each designation, the organizations are subject to other specific obligations regarding accountability and are also under specific legal forms to enter into agreements and partnerships with the government.

There is a specific framework in place, separate from the above, for International Non-Profits seeking to establish a branch operation. This is best achieved with local professional advice and assistance.

Political Activities, Relationship with the Public Sector, Accountability

Brazilian law generally does not impose restrictions on the ability of Foundations and Associations to engage in legislative or political activities. These entities may freely support candidates for public office as well as support any kind of legislation on its way through the political process. Any restriction on political activities would be contained in the organization's governing documents.

The only express limit concerns Civil Society Organizations for the Public Interest, which may not take part in a political campaign under any circumstances, or support political parties or politicians in any way. These restrictions cover political party activity and the nomination of candidates for parliamentary and local governmental elections at the county level.

The law does not expressly bar political or legislative activities by public foundations or social organizations. However, the nature of their respective structures and activities may implicitly keep them from participating in political issues.

Some programs and projects are financed by resources coming from the fiscal and social security budget, through the execution of covenants, transferring contracts or cooperation agreements. Before entering into covenants, contracts or cooperation agreements, all non-for-profit private entities must be enrolled with the SICONV – a system set up by the Ministry of Planning, Budget and Management.

Covenants or contracts providing for the transfer of public funds are forbidden when entered into with non-for-profit private entities whose directors are members of the Executive, Legislative and Judiciary Powers, of the Office of the Public Attorney, the Court of Audit, or any civil servant subject to the authority or entity responsible for the financial resources, as well as their consorts, companions and relatives in collateral whether in a straight line or in-laws, until the second degree.

In order to evaluate technical qualification, operational and management capabilities of such entities, public callings can be held before the execution of covenants.

Specific laws that have created the designations mentioned above have also created forms of relationships between the non-profits and the government. One example is the Partnership Termsheet, governing partnerships between an OSCIP (Civil Society Organizations for the Public Interest) and the government. Through this contract, an OSCIP may receive government funds or other government support to execute projects in the public interest. This contract aims to improve cooperation between the government and these organizations and to encourage OSCIPs to undertake the public interest activities set forth in the law.

The same law has also created the specific accountability obligations, such as the need of publishing balance sheets, evidence of payment of labor and social security rights of the employees as further reporting of activities.

Since January 2007 all OSCIP entities holding Public Utility Status as well as other foreign organizations authorized to run activities in Brazil must get enrolled with a National System of Entities Qualified by the Ministry of Justice.

The National System (CNE) is considered an effective legal vehicle for non-profit organizations to make public their financial accounts and reports regarding activities carried out during the year and this can be done electronically. Upon rendering accounts on time, OSCIPs may obtain through the system a ?Regularity Certificate?, which has become necessary for the execution of future Partnership Termsheets.

Incentive Laws and Fundraising

There are several laws and regulations providing tax incentives around donations made to non-profit organizations in order to ensure financial sustainability and to enhance private and public partnerships with the non-profit sector. This is specifically in place to help develop projects that match the guidelines and public policy priorities regarding culture, children and adolescents and environmental conservation at the federal, state and municipality levels.

One of the tax incentives applied on a large scale is that on corporate contributions to organizations granted federal designation as Public Utility Status or Civil Society Organization for the Public Interest with funds going to them thus being deductible for income tax purposes.

The National Cultural Programme (Pronac) created in 1991 allows cultural projects approved by the Ministry of Culture to receive sponsorships and donations from companies and individuals, which may deduct – totally or partially – the amount invested from their income tax. Many Brazilian states also have additional have laws concerning contributions for cultural projects and tax exemptions of ICMS (Brazilian VAT) for donors and sponsors.

The Council of Public Policies for Children and Youth has a Fund composed of government revenue as well as corporate and individual donations. The resources of the Fund are used in the implementation of public policies for children and youth and can be distributed to certified organizations.

The newest incentive law for support to projects of public interest is the one related to sport. Enacted at the end of 2006 it is being put into motion this year. It stipulates that sport and para-sport activity projects approved by the Ministry of Sport may receive sponsorships and donations from companies and individuals, which are totally or partially tax deductible for income tax purposes, up to a certain amount established by law (6% for individuals and 1% for companies).

Donations and sponsorships cannot involve professional athletes and projects combining education and sport must reach at least 50% of students from public schools of the surrounding area where they are carried out.

With regard to tax incentives in the context of environmental protection, there is a facility for voluntarily designating areas for conservation (Private Reserves) and thus they may qualify Rural Real Estate Tax exemption. Also, some states have designated part of their VAT revenues to the maintenance of public nature conservation areas, sometimes maintained and managed by non-profits duly qualified and contracted under covenant or partnership agreements.

There is a joint effort being made by companies and non-profit organizations for the enactment of a law providing for income tax benefits linked to environmental projects (the so-called ?Ecological Income Tax?).

Incentives around preferential tax treatment, with possibility of deduction of amounts granted from income, value added, rural property taxes and corporate social contributions, social investment made by large to medium and even small enterprise is quite intensive in Brazil, as is indeed one of the main pillars of most corporate social responsibility programs.

Conclusion

?The Brazilian third sector has seen rapid growth since the seventies – first informally as a civil society parallel for action during the military dictatorship and then from the mid-eighties onwards through formally structured entities.

- Non-profit organizations can partake in political debate if their constitution allows it and there are controls in place to prevent public funds going through third sector organizations for this purpose.

- ?here is strong regulation in place to govern the financial flows and thus ensure accountability – which have been put in place in order to deal with sometimes perceived inefficiencies and in some extreme cases corruption. Also, it will be interesting over time to see if a culture of increased public philanthropy can take hold as many organizations we have spoken to are hoping. This would help organizations be less dependent on corpororate and thus CSR-objective aligned funding.

- Many organizations could also benefit from looking abroad for funding but this will require them stepping up their communication activities in English (many overseas funders do not speak Portuguese). The need for audited financial and results reporting that suits the international donor community should also not be underestimated. For this we recommend using established local professional services with a proven track record.

- At the same time we call on international funders and individuals to look again at Brazil as a viable country for social investment where a lot can be achieved, sometimes with surprisingly few resources.

References:

- Statistics on Non-Profit Private Foundations and Associations in Brazil: www.ibge.gov.br/english/presidencia/noticias/noticia_visualiza.php?id_noticia=273&id_pagina=1

- Further Non-Profit related reading on Brazil: www.brazilink.org/brazil_nonprofit.asp

- World Social Forum: www.forumsocialmundial.org.br/ (English available)

About the authors:

Juliana Amaral Toledo is a Graduate of the Law faculty of the University of São Paulo (USP), currently partner of Figueirêdo Lopes, Golfieri, Toledo e Stordo Advogados, a law firm specialized in legal assistance for sustainability, inclusive development and corporate social responsibility projects and in legal assistance to Brazilian and International Non-Profit Organizations. She has also been a lecturer on the post-graduate level course ?Third Sector and Sustainable Tourism? at SENAC (2006) and has a Masters in the management of non-profit organizations, cooperatives and custainable enterprises at Bocconi University ? Scuola di Direzione Aziendale, Milan Italy .

Co-Founder of the ONG Oltre ? Food for Brains, an Italian non-profit organization with projects related to culture and education for community development in Tanzania, Toledo is also a member of the International Society for Third Sector Research (ISTR). Finally she has co-authored a manual called Pro Bono Legal Assistance – A Practical Guide to Law Firms as member of the Pro Bono Committee of CESA – Center of Studies of Law firms.

To contact her write to juliana@amaraltoledo.com.br

Michael Ambjorn is founder of the Brazilian social enterprise Tactical Communications which runs the São Paulo e-Intelligence Programme, training the 3rd sector, academics and activists to use the web for better communication both internally, externally; locally and globally to bring about social change. Ambjorn is also trustee of the Brazilink Foundation, the web's leading, expert-edited, reference point on resources on Brazil – helping connect people, ideas and information on Brazil. As well as being an advisor for a range of leading edge small-footprint, big-impact organisations and author of the blog Tools, Thoughts and Things one can Do with a little Time and Hardly any Resources, he has in the past been a Special Interest Group Chair and Member of the ACEVO International Programme (Association of Chief Executives of Voluntary Organizations).

To contact him write to: michael@ambjorn.com

Interesting links:

- www.senac.br

- www.oltrefoodforbrains.it

- www.istr.org

- www.tacticalcommunications.org

- www.brazilink.org

- http://consulting.ambjorn.com/

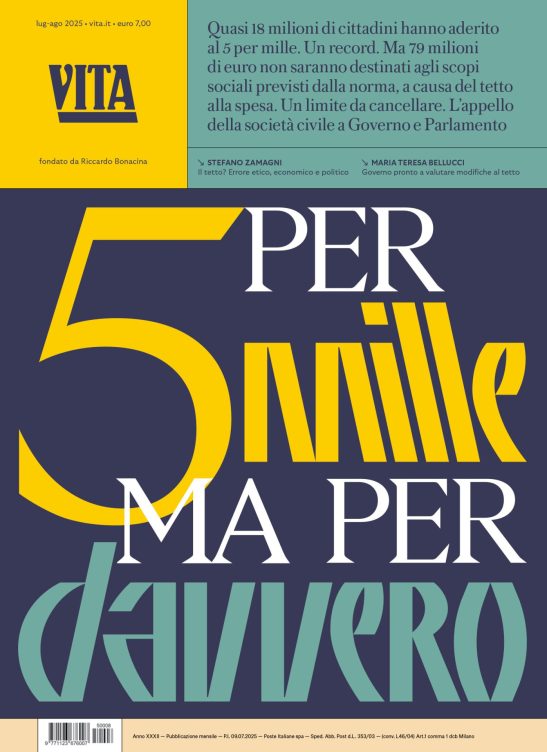

Si può usare la Carta docente per abbonarsi a VITA?

Certo che sì! Basta emettere un buono sulla piattaforma del ministero del valore dell’abbonamento che si intende acquistare (1 anno carta + digital a 80€ o 1 anno digital a 60€) e inviarci il codice del buono a abbonamenti@vita.it