Microfund us out of the crisis

Could European micro-funding schemes be a glimmer of hope for Greece's ailing economy?

di Staff

As the Greek middle-class takes to the streets to protest against austerity and financial crisis, and politicians fear that the country’s entire economy will default micro-enterprises offer a glimmer of hope.

The European scheme called Progress Microfinance Facility launched in 2010 in order to stimulate the availability of small loans to set up micro-enterprises announced last month that a Greek microcredit provider has joined the scheme and will make 6 million euros worth of microloans available to Greek micro-entrepreneurs, with a focus on financing start-ups up to three years and new borrowers with a robust business plan.

Pancretan Cooperative Bank Ltd (PCB) will also make a further senior loan available of up to 8.75 million euros to meet the demand of numerous micro-enterprises facing difficulties in accessing finance due to the credit crunch and the stricter eligibility requirements applied by the Greek banking sector. It is expected that PCB will generate up to 13 million euros in microloans to micro-enterprises.

The European Progress Microfinance Facility (Progress Microfinance) is an EU microfinance initiative established with 203 million euros of funding from the European Commission and the European Investment Bank and managed on their behalf by the European Investment Fund.

Progress Microfinance aims to increase access to finance for micro-entrepreneurs, including the self-employed. It has a particular focus on, but is not restricted to, groups with limited access to the conventional credit market. Examples include female entrepreneurs, young entrepreneurs, entrepreneurs belonging to a minority group, entrepreneurs with a disability, sole traders etc. Loans of up to 25,000 euros are made available through selected microfinance intermediaries participating in the facility.

Progress Microfinance does not provide direct financing to micro-entrepreneurs or individuals, but it works through microfinance providers, such as Pancretan Cooperative Bank in Greece.

To find out how to apply to this and other funding opportunities: http://ec.europa.eu

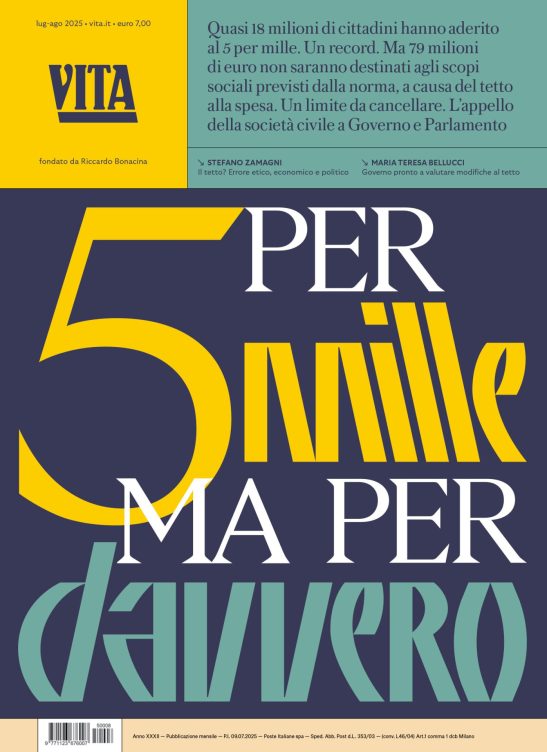

Si può usare la Carta docente per abbonarsi a VITA?

Certo che sì! Basta emettere un buono sulla piattaforma del ministero del valore dell’abbonamento che si intende acquistare (1 anno carta + digital a 80€ o 1 anno digital a 60€) e inviarci il codice del buono a abbonamenti@vita.it