Famiglia

Poland: fight for 1% of citizens tax liabilities

April is the month of numerous campaigns and actions that Polish NGOs of the public benefit status organize to fight for 1% of citizens tax liabilities

The Act on Public Benefit Activity and Volunteer Work, passed in Poland in 2003, enabled organizations that met certain criteria to receive a status of a public benefit organization, a status which allows such organizations to receive every year up to 1% of an individual?s tax liabilities.

According to the Act (and accompanying regulations of laws on individual income taxes) most Polish citizens that pay individual (not corporate) taxes can designate 1% of the taxes they owe the government to a chosen organization of public benefit status, instead of to a government tax agency.

Since Polish citizens have to file their tax returns for the previous years until the end of April and most do so just in April, at the last moment, most organizations of public benefit status spend April on conducting various actions and campaigns to convince citizens that they should designate this 1% of their tax liabilities just to them. Also, they all try to convince citizens to use this 1% mechanism at all. Over the last two years many organizations intensified their campaigns to encourage individual taxpayers to make contributions from their tax liabilities, and, as a result, the number of citizens that paid 1% of their tax liabilities to chosen nonprofits increased from less than 3% in 2004 to 4.85% in 2005. In 2005 therefore, one in twenty individuals used the 1% law. This percentage is, however, still very low.

There are a few reasons for that. One is still low awareness of this mechanism and this is why many campaigns of Polish nonprofit organizations representing the interest of the whole sector have as an aim to inform Polish citizens about this mechanism and encourage them to use it.

But also, the procedures required to designate this 1% discouraged many individuals from doing so. Most of all, citizens have to pay the money first, and then wait for months for the reimbursement. There is a good chance, however, that the procedures will change already next year.

The number of campaigns on the 1% mechanism, as in previous years, triggered many discussions on this mechanism. They included some critics of the mechanism.

One of them is that the mechanism (as the whole Act on Public Benefit and Volunteer Work) clearly favors bigger organizations in a way that other organizations have less chance to gain the status of organization of public benefit that could enable them to compete for 1% of tax liabilities of taxpayers. Small organizations typically do not meet criteria to receive such a status. The threshold and requirements to receive the status of organization of public benefit are, according to some respondents, too high for them and too high, in general. Also, even if small organizations receive the status of public benefit, they still usually have no resources to advertise their organizations and encourage citizens to give them this 1%. It is also worth noting that small, community-based organizations also tend to exist in rural areas, and farmers do not pay taxes 1% of which they could allocate to nonprofit organizations.

But one of the most severe piece of critics comes from the few years experience of observing the nonprofit sector after the introduction of the mechanism. Some experts are starting to believe that 1% mechanism has been crowding out donations. According to them the introduction of this mechanism, in fact, diminished the amount of total revenues of the nonprofit sector. This is so because, according to these experts, many people started considering this 1% as philanthropy and together with designating 1% of their tax liabilities to selected nonprofit organizations stopped giving donations. At the same time, the revenues from 1% and donations in the years since the Act was passed turned out to be lower than the revenues only from donations in previous years (which actually is a fact).

This casual correlation has not been proven yet, but seems to be quite a likely mechanism, which some thinkers had warned against already before the Act introducing the mechanism was passed. 1% is not philanthropy because people using this mechanism do not sacrifice any own resources, but only redirect some of their tax liabilities to the nonprofit sector instead of the government budgets. Yet for many people each act of paying some money to the nonprofit organization constitutes philanthropy.

Therefore, the mechanism of 1% that was meant to increase the total revenues of the Polish nonprofit sector, might have, in fact, worked in the other direction.

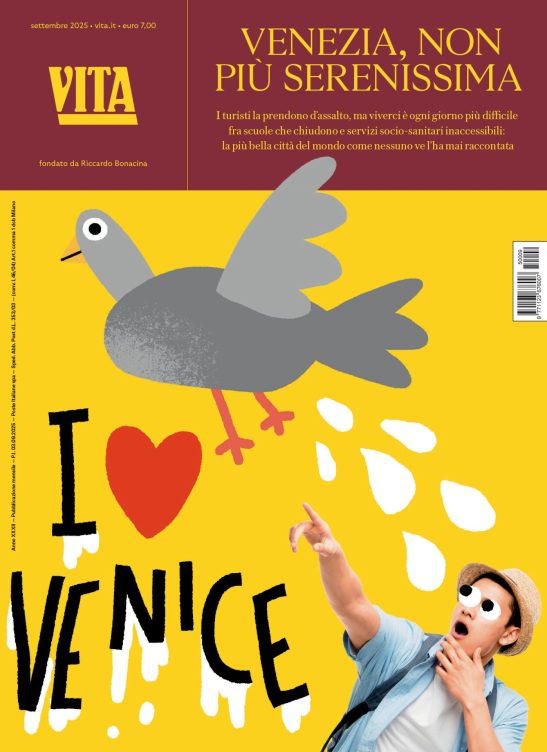

Si può usare la Carta docente per abbonarsi a VITA?

Certo che sì! Basta emettere un buono sulla piattaforma del ministero del valore dell’abbonamento che si intende acquistare (1 anno carta + digital a 80€ o 1 anno digital a 60€) e inviarci il codice del buono a abbonamenti@vita.it